About the Conference on Mathematics and its Applications (CMIA)

The Centre is excited to organize this conference within the framework of the German Research Chair program at AIMS Ghana, under the Alexander von Humboldt Foundation, the German Ministry of Education and Research and the DAAD Foundation. This conference will provide an avenue for researchers in the Mathematical Science field to share their work, connect and network with others in their various disciplines. The event more particularly seeks to increase the cooperation between students and researchers in Mathematics and its Applications on one hand, and various institutions and research centers on the other hand.

Objectives

The conference objectives are to:

- Provide the platform for researchers in Mathematical Sciences and its Applications to share and present their research.

- Introduce students to concepts in mathematical modeling and applications that are not normally taught in their universities/institutions.

- Introduce to young researchers the various researchable questions in Mathematics and its Applications while encouraging them to pursue research.

- Provide the platform for researchers to collaborate/ work in teams to solve developmental problems across the world.

Application and Requirements

Thanks to the sponsorship of the Alexander von Humboldt Foundation, the German Ministry of Education and Research, and the DAAD, and AIMS Ghana, there are no registration fees for all research students and academics.

For more information download PDF:

DownloadTo apply, visit this LINK.

Application Deadline: 13th October 2024

CMIA Partners

Event partners:

The Alexander Von Humboldt Foundation

The German Federal Ministry of Education

German Academic Exchange Service (DAAD)

Organisers:

- Peter Imkeller, Humboldt University

- Olivier Menoukeu Pamen, U Liverpool and AIMS Ghana

- Rhoss Likibi Pellat, AIMS Ghana

- Prince Osei, AIMS Ghana

Travel Guide

Routine Vaccines:

Be sure that your routine vaccines, as per your province or territory, are up-to-date.

Some of these vaccines include: measles-mumps-rubella (MMR), diphtheria, tetanus, pertussis, polio, varicella (chickenpox), influenza and others.

Pre-travel vaccines and medications:

You may be at risk for preventable diseases while travelling to this destination. Talk to a travel health professional about which medications or vaccines are right for you.

Diseases include:

Hepatitis A

Yellow Fever – Country Entry Requirements

Rabies

Measles

Hepatitis B

Polio

Influenza

Meningococcal disease

Malaria

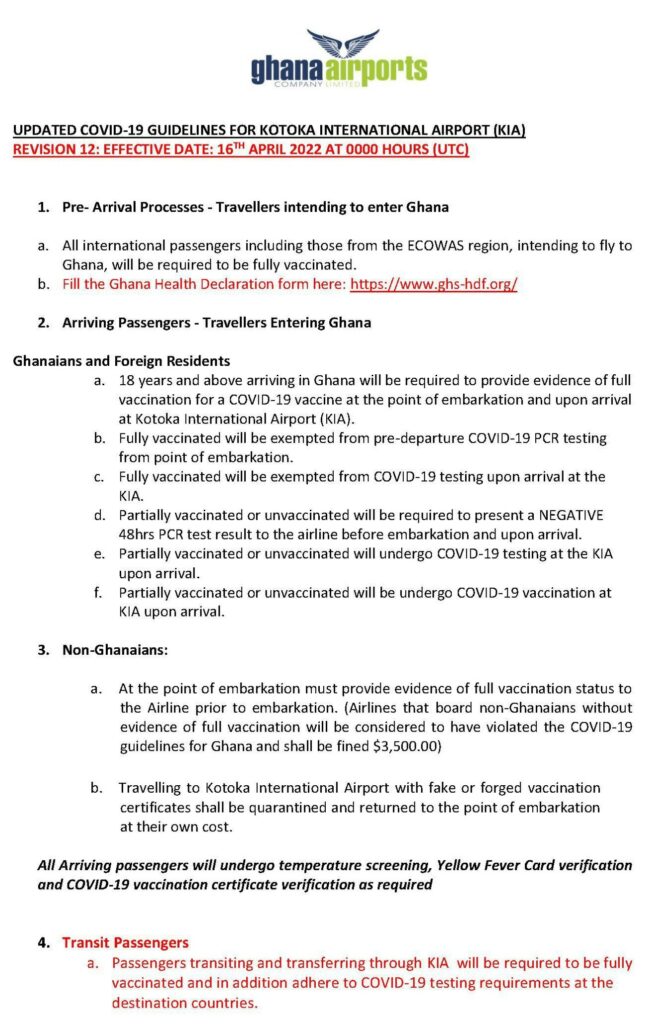

COVID-19

Food and Water-borne Diseases

Travel health and safety:

Emergency medical attention and serious illnesses require medical evacuation. Medical services usually require immediate cash payment.

Make sure you get travel insurance that includes coverage for medical evacuation and hospital stays.

Prescription drugs

If you take prescription medication, you are responsible for determining its legality in Ghana.

Precautions

- Bring sufficient quantities of your medication with you

- Always keep your medication in the original container

- Carry a copy of your prescription(s)

- Pack them in your carry-on luggage

List of Participants

- Woundjiague Apollinaire, Cameroon

- Shaibu Osman, Ghana

- Matthews Sejeso, South Africa

- Latévi Lawson, Togo

- Miracule Daniel Gavor, Ghana

- Audace Amen V. Dossou-Olory, Benin

- Filone Gilson Longmou Moffo, Cameroon

- Michael Manford, Ghana

- Angela Tabiri, Ghana

- Elizabeth Dadzie, Ghana

- Benjamin Kwaku Nimako, Ghana

- Jake Leonard Nkeck, Cameroon

- Winfrida Mwigilwa, Tanzania

- Yawo Kobara, Ghana

- Seynabou Gueye, Senegal

- Edward Korveh, Ghana

- Abigail Baidoo, Ghana

- Kennedy Gyimah, Ghana

- Ndayikunda Yvette, Burundi

- Dominic Owusu Abeyie, Ghana

- Ywo Josué Bazie, Burkina Faso

- Abdellahi Soumaré, Mauritania

- Jules Sadefo Kamdem, France

- Wilfried Kuissi Kamdem, Cameroon

- Cedric Kuk Abekah Koffi, Ghana

- Wuraola Ademosu, Nigeria

- Adenike Adeniji, Nigeria

- Rémi Cocou Avohou, Benin

- Maalvladedon Ganet Some, Burkina Faso

CMIA 2024 Speakers

- Auguste Aman, University Félix Houphouët-Boigny, Abidjan

- Stefan Ankirchner, Friedrich Schiller University Jena

- Moustapha Dieye, Ecole Polytechnique Thies

- Cyrille Nana, University of Buea

- Mouhammadou Sy, AIMS Senegal

CMIA Abstracts

Lecture 1

Name: Mouhamadou Sy

Title: Qualitative study of dispersive PDEs

Abstract:

In this course, we will develop techniques that are essential to study existence, uniqueness and regularity of nonlinear dispersive PDEs, such as the nonlinear Schrödinger equations. We will discuss the influence of the geometry of the physical space in such well posedness theory. As for globalization in time for local theories, we will analyze the classical deterministic approach and its limitations, before exploring some powerful probabilistic alternatives.

Lecture 2

Name: Stefan Ankirchner

Title: Diffusion control ranking games

Content

1. Diffusion control with threshold rewards

2. A diffusion control game

2.1 Two player version

2.2. Mean-field version

3. The role of correlation in the two player game

Abstract:

In this lecture we first discuss diffusion control problems, where the controller can choose the diffusion intensity of a state process and where the reward depends on whether the final state is above or below a given threshold.

The second part aims at analyzing the effect of interaction on diffusion control strategies. To this end we consider a symmetric stochastic differential game where each player can control the diffusion intensity of an individual dynamic state process, and the players whose final states are among the highest receive a fixed prize. We explain how to get an explicit solution in the 2 player case. We then consider the mean-field version of the game and derive approximate Nash-equilibria for games with many players.

In the last part we discuss the role of correlation of the state processes in the two player case.

Name: Auguste Aman

Title: Contribution on study of delayed forward backward SDE to modeling financial theory

Abstract:

The mean objective of this topic is give more contribution of delayed forward-backward SDE to model the financial object. Among other things, we derive an explicit formula for a price of an European option associated to the underlying delayed stock price which follows a linear differential equation with a general delay in the drift term. We use an equivalent martingale measure method based on Girsanov’s property. In the event that it is impossible to find a martingale measure, we introduce the link with backward stochastic Volterra equations.

MSC: Primary: 60F05, 60H15; Secondary: 60J30

Keywords: Forward-backward stochastic differential equation; Black and Scholes formula; Equivalent martingale measure; Option pricing; time delayed generators, Stochastic functional differential equation

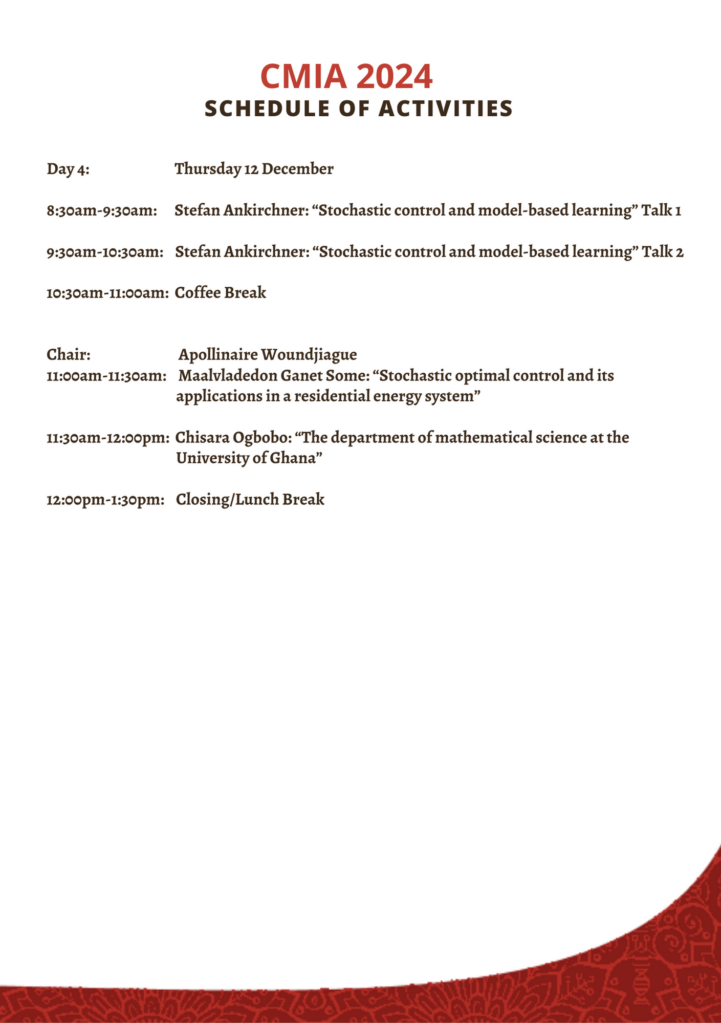

Name: Stefan Ankirchner

Title: Stochastic control and model-based learning

Abstract: TBA

Name: Moustapha Dieye

Title: Controllability of Volterra Evolution Equations with Impulsive Terms

Abstract:

This talk explores the controllability of a Volterra evolution equation characterized by impulsive terms and nonlocal initial conditions. We define mild solutions using the resolvent operator associated with the linear part of the equation. We note that this operator lacks compactness and equicontinuity, and does not require compactness for the impulsive and nonlocal functions. We present sufficient conditions for controllability through noncompactness measures in Banach spaces. These results apply to functional differential equations and hyperbolic partial differential equations.

Name: Cyrille Nana

Title: Hilbert-type inequalities in homogeneous cones.

Abstract:

In this talk, we are concerned with the estimates of a class of Hilbert operators associated with homogeneous cones. This leads to some Lp estimates of some Bergman type operators and then the Lp estimates of the Bergman in tube domains over homogeneous cones

Contributed Talks

Name: Adeniji Adenike Olusola

Title: Interpolative Characterisation Of Full Transformation Semigroup

Abstract:

Interpolation is defined on transformation semigroup to obtain polynomial functions whose graphs are of varied forms. It was shown in this work that only two elements are linear, n – elements have constant graphs and others are neither odd nor even. Also, idempotent elements of the same kernel have the same graphs and are inverse pair.

Name: Rémi Cocou Avohou

Title: Enumerating Invariant Observables in Tensor Models: A Symmetric Group-Theoretic Approach

Abstract: TBC

Name: Audace Amen V. Dossou-Olory

Title: Decks and multidecks of rooted rooted phylogenetic tree shapes

Abstract:

We are concerned with rooted phylogenetic tree shapes, i.e. the unlabeled trees underlying the leaf- labeled phylogenetic trees. The k-deck of a rooted binary tree with n leaves is the set of isomorphism classes of its k-leaf induced binary subtrees, while in the k-multideck the isomorphism classes come with the count of how many times they arise.

The graph reconstruction conjecture states that every graph G on at least three vertices is uniquely determined (up to isomorphism) from the multiset of graphs obtained by deleting one vertex in every possible way from G. Motivated by this famous conjecture, this research investigates extremal problems related to decks and multidecks of rooted binary trees, which are essential in understanding phylogenetic structures. Specifically, we focus on reconstructing trees from their (multi)decks and provide theoretical bounds on the minimum deck size required for unique reconstruction.

Let R(n) (resp. R(m, n)) denote the minimum positive integer such that every rooted binary tree on n leaves is determined by its size R(n)-deck (resp. size R(m, n)-multideck). The main results include lower and upper bounds for the deck reconstruction number R(n) and the multideck reconstruction number R(m, n). Furthermore, we characterize trees that possess minimum and maximum deck sizes, showing that the minimal deck size occurs uniquely for so-called (k, l)-jellyfish structures. Through exhaustive computations, we explore k-universal trees that include all possible k-leaf subtrees. The findings contribute to the theoretical framework needed for tree reconstruction and provide new insights into the combinatorial properties of phylogenetic trees.

Keywords: rooted binary trees, decks, graph reconstruction, universality.

Name: Michael Manford

Title: Parameter Estimation of an Alternative Multivariate Exponential Power Distribution – Application in Discriminant Analysis

Abstract:

An Alternative Multivariate Exponential Power Distribution (AMEPD) has already been proposed as a more generalized form of the traditional MEPD which includes the multivariate normal distribution. The new AMEPD is demonstrated to provide enhanced flexibility in depicting the assumed underlying symmetric distribution of a dataset. In order to provide further performance assessment, this study presents the methodology of maximum likelihood estimation of the parameters of the new distribution. The estimation procedure is found quite intriguing since the new distribution now involves a generalized expression, c, in place of the constant coefficient (0.5) for the function of the quadratic form in the widely-used MEPD. The estimation is implemented via Newton-Ralphson optimization method. Based on both simulated and empirical datasets, the results of the AMEPD are compared with those of the MEPD using information criteria. With equal cost of misclassification, further assessment is carried out in the determination of a discriminant problem in which the distribution is found to perform optimally under condition of unequal variance-covariance matrices with much smaller average performance error rate. Consistent with previous studies, the advantage of the new distribution is affirmed in all the applications.

Name: Yawo Mamoua KOBARA

Title: Capacity Estimation in a Queueing System: Healthcare Case

Abstract:

Data-driven capacity estimation is one of the most significant issues in practical queuing theory. While several models have been proposed in the literature, they typically assume the presence of complete information, i.e., time stamps for arrivals, service starts, and departures. In many practical settings, only a subset of these timestamps is available (often consisting of system arrivals and departures).

This paper presents two simple algorithmic approaches to estimate the capacity of a partially observable G/G/c queueing system. The observer can only see the arrival and departure times of the customers and wishes to estimate the number of servers.

One algorithm is based on Krivulin’s recursion, while the other one is based on the number of overtakes. Using both, synthetic data, and real-life data from the emergency department of a larger urban hospital data, a comparative evaluation of the two algorithms is conducted. Our results show for a stationary G/G/c system, our algorithms produce extremely accurate estimates of the number of servers based on rather limited data.

Name: Abekah Cedric Koffi

Title: Impact of social factors on loan delinquency in microfinance

Abstract:

In this work, we develop multistate models to analyse loan delinquency in the microfinance sector, using data from Ghana. The models are designed to account for both partial repayments and the short repayment durations typical in microfinance, focusing on estimating the probability of transitions between two or three repayment states, including delinquency. Social variables, such as religious and cultural factors, were found to play a statistically significant role in influencing repayment behavior, highlighting the impact of societal dynamics on financial outcomes. We explored both time-independent and time-dependent frailty models to capture unobserved heterogeneity. Overall, the findings emphasize the importance of social factors in delinquency but suggest limited predictive gains from incorporating frailties into multistate models.

Name: Wilfried Kuissi Kamdem

Title: Optimal consumption with labor income and borrowing constraints for recursive preferences

Abstract:

In this talk, we present an optimal consumption and investment problem for an investor with liquidity constraints who has isoelastic recursive Epstein-Zin utility preferences and receives a stochastic stream of income. We characterize the optimal consumption strategy as well as the terminal wealth for recursive utility under dynamic liquidity constraints, which prevent the investor to borrow against his stochastic future income. Using duality and backward SDE methods in a possibly non-Markovian diffusion model for the financial market, this gives rise to an interplay of singular control and optimal stopping problems. Our analysis extends to more general liquidity constraints. (Joint work with Dirk Becherer and Olivier Menoukeu Pamen).

Name: Latevi M. Lawson

Title: Crossed module of semisimple Hopf algebra

Abstract:

Keywords: Hopf module; Hopf algebra; Haar integral; Semisimplicity and Cosemisimplicity; Crossed module Hopf algebra; semi-direct product Hopf algebra

References

[1] David E. Radford. Hopf algebras., volume 49 of Ser. Knots Everything. Hackensack, NJ: World Scientific, 2012.

[2] F. Quinn. Lectures on axiomatic topological quantum field theory. In D. Freed and K. Uhlenbeck, editors, Geometry and Quantum Field Theory, volume 1 of IAS/Park City Mathematics Series. AMS/IAS, 1995

Name: Filone Gilson Longmou Moffo

Title: Probabilistic globall-wellposedness for energy-supercritical Schrodinger equations on compact manifolds

Abstract:

The Schrödinger equations are at the heart of numerous physical phenomena, ranging from quantum mechanics to particle interactions and optical systems; they model wave propagation. In this presentation, we consider the nonlinear Schrödinger equations with a nonlinearity power greater than or equal 3, which includes notably the energy supercritical regimes in dimensions higher than or equal 3. We prove almost sure global wellposedness and bounds on the growth in time of the solutions via invariant measure arguments. Our setting includes a generic compact Riemannian manifold; we specify the cases of the torus and of Zoll manifolds.

Name: Winfrida Felix Mwigilwa

Title: Optimal Reinsurance-Investment for Two Insurance companies under GMR with Federal Income Tax and Dividends

Abstract:

This paper investigates a zero-sum stochastic differential game involving a large insurance company and a small insurance company. The large insurance company has sufficient assets to invest in both a risk-free asset and a risky asset. The price process of the risky asset follows the Geometric Mean Reversion (GMR)

model, and takes into account dividend payments and federal income tax. The small insurance company invests only in the risk-free asset and is subject to federal income tax on the interest earned. Both insurance companies purchase reinsurance, with the reinsurance premium determined by the expected value principle. The large insurance company seeks to maximize the expected exponential utility of the difference between its surplus and that of a small company to maintain its surplus advantages, while the small insurance company aims to minimize the same quantity to reduce its disadvantages. By applying dynamic programming principle, we establish the corresponding Hamilton-Jacobi-Bellman (HJB) equations and derive optimal reinsurance-investment and investment-only optimal strategies. Finally, numerical simulations are conducted to illustrate our findings.

Keywords: Federal income tax; Geometric Mean Reversion model; a zero-sum stochastic differential game; expected value principle; optimal investment strategy.

Name: Jake Leonard Nkeck

Title: Defect-correction Finite Element Methods for Eliptic and Parabolic problems on polygonal domains.

Abstract:

The problem of studying the behaviour of solutions of initial boundary value problems for partial differential equations on polygonal domains is of great importance in mathematics and its applications. On two-dimensional domains are these problems sometimes confronted to corner singularities; this can affect the convergence of Finite Element Methods. Furthermore, initial boundary value Problems involving partial differential equations may be confronted to time-dependent singularities due to the right hand side function. This talk considers as model problems the Dirichlet boundary value problem for the Poisson, the time-harmonic Maxwell, and the Heat equations on polygonal domains and derive, on one hand, explicit computable formulas for the singular solutions. On the other hand, the formulas of the singular solutions are used to construct an efficient adaptation for the Galerkin finite element methods via a predictor-corrector algorithm. For the temporal discretization, the classical Crank-Nicolson

method is employed. A priori error estimates in the L2 – and H1-norms for both the semi- discrete as well as for the full discrete problems show that on non-convex polygonal domains the new adaptation exhibits the same order of accuracy as it is known for problems with regular solutions. Numerical experiments are included to illustrate the practical implementation of the adaptive method and to confirm the theoretically expected rates of convergence.

Keywords: Singularities; Predictor-corrector method, Finite Element Method, Crank-Nicolson method, Non-convex domain, Poisson Equation, Maxwell’s Equations, Heat Equations.

Name: Jules Sadefo Kamdem

Title: Financial Quantification of Cyber-Risk using Machine Learning Models and Generalized Extreme Value Distributions

Abstract: In this paper, we estimate the cost of a data breach using the number of compromised records. The number of such records is predicted by means of a machine learning model, particularly the Random Forest. We further analyse the fat tail phenomena which capture the underlying dynamics in the number of affected records. The objective is to calculate the maximum loss in order to answer the question of the insurability of cyber risk. Our results show that the total number of affected records follow a Frechet distribution, and we then estimate the Generalized Extreme Value (GEV) parameters to calculate the value at risk (VaR). This analysis is critical because it gives an idea of the maximum loss that can be generated by an enterprise data breach. These results are usable in anticipating the premiums for cyber risk coverage in the insurance markets.

Key words: Cyber insurance; Cyber risk; Machine Learning; Regression Trees; Random Forest; Generalized Extreme Value

Name: Maalvladedon Ganet Some

Title: Stochastic optimal control and its applications in a residential energy system

Abstract:

We consider a residential heating system in which several prosumers satisfy their energy demand using a renewable source and services of a

central producer. Energy overproduction can either be stored in a local storage or sold to the central producer. Our focus is the minimization of the prosumers’ expected discounted total cost from purchasing and selling energy and running the system. This decision making problem under uncertainty about the future production and consumption of energy is formulated as a stochastic optimal control problem. We present the model and discuss the solution technique.

Name: Matthews M. Sejeso

Title: Optimization Framework for Fair and Efficient Campus Parking Allocation

Abstract:

Efficient parking space management is a global challenge, as cars are used daily to commute to workplaces, universities, and other destinations. On university campuses, where parking demand often exceeds supply, allocating parking spaces becomes a complex optimization problem involving diverse user priorities and limited resources. This study employs mathematical optimization to develop a robust parking allocation framework that minimizes dissatisfaction while maximizing resource utilization and ensuring fairness. The model incorporates dynamic importance functions based on user rank and tenure, periodic reassessment to adapt to changing needs, and proportional allocation across user classes, with additional constraints for accessibility compliance. A mathematical review of the framework is presented, and its effectiveness is demonstrated through a campus case study, offering actionable insights for parking management challenges.

Name: Apollinaire Woundjiague

Title: Optimal Investment – Consumption – Insurance with Partial Information and Correlation Between Assets Price and Factor Process

Abstract:

In this paper, we present an analysis of the optimal investment, consumption, and life insurance acquisition problem for a wage earner with partial information. Our study considers the nonlinear filter case where risky asset prices are correlated to the factor processes under constant relative risk aversion (CRRA) preferences. We introduce a general framework with an incomplete market, random parameters adapted to the Brownian motion filtration, and a general factor process with a nonlinear state estimation and a correlation between the state process (risky asset prices) and the factor process. We then obtain the nonlinear filter through the Zakai equation and derive a system consisting of a Hamilton-Jacobi-Bellman equation and two backward stochastic differential equations. Finally, we establish the existence of the solution, prove the verification theorem, and construct the corresponding optimal strategy.

Keywords: optimal investment, factor processes, nonlinear filter, Zakai equation, Hamilton-

Jacobi-Bellman equation